The health care facility in India remains widely a high-priced affair. With ever-increasing instances of illness, health insurance has grown to much required financial backup at the time of medical distress. There are various benefits of health insurance, and one of them is income tax privileges. Payments made towards the premium of health insurance are qualified for tax deductions under section 80D of the

Indian Income Tax Act, 1961.

Mr. Ahluwalia purchased

health insurance for himself (age 35), his spouse (age 35), his child (age 5), and his parents (age 65 and 67, respectively). At the time of the financial year, his friend asks him if he could help him fill up the ITR form to claim tax deduction payment towards medical or health insurance payment. He was confused; what is Section 80D? Why does one need to claim the tax deduction for health or medical insurance premium?

Just like Mr. Ahluwalia, many other taxpayers need to know the importance of Section 80D while buying health or medical insurance. There are many other questions, and is proof required for 80D while filling up the taxation for the financial year? Or, in case of an emergency, can medical expenses be claimed under 80D? Let us understand this in the article below.

What is section 80D?

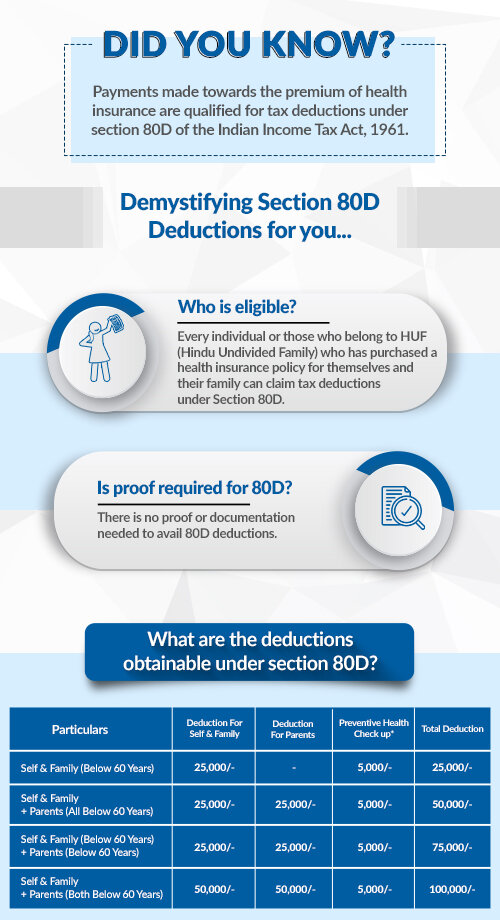

Every individual or those who belong to HUF (Hindu Undivided Family) who has purchased a health insurance policy for themselves and their family can claim tax

deductions under Section 80D of up to INR 25,000. An increased deduction introduced by the Indian Income Tax Act of INR 50,000 and a maximum of INR 1 lakh if the parents of the primary policyholder are

senior citizens aged 60 years and above, and a maximum of INR 40,000 for citizens less than 60 years.

Is proof required for 80D?

There is no proof or documentation needed to avail 80D deductions.

Tax Deductions Permissible Under Section 80D

- Premium paid for self, family — INR 25,000 and parents (below 60 years old) — INR 25,000, the deduction under Section 80D will be INR 50,000.

- Premium paid for self, family — INR 25,000 and parents (above 60 years old) — INR 50,000, the deduction under Section 80D will be INR 75,000.

- Premium paid for self, family (above 60 years)— INR 50,000 and parents (above 60 years old) — INR 50,000, the deduction under Section 80D will be INR 1,00,000.

- For Hindu Undivided Family (HUF) — Premium paid for self, family — INR 25,000, and parents— INR 25,000, the deduction under Section 80D will be INR 25,000.

- For Non-Resident Individual — Premium paid for self, family — INR 25,000, and parents — INR 25,000, the deduction under Section 80D will be INR 25,000.

Can medical expenses be claimed under 80D?

Yes. Under section 80D, it allows the policyholder to save tax by claiming medical insurance incurred on self, spouse, dependent parents as a deduction from income before paying the taxes. The person's age should be 60 years or above to be eligible to

claim the medical expenses. Also, the person should not have any health insurance policy. One can claim a maximum deduction of INR 50,000 in a financial year. To claim the deduction, all the medical expenses need to be paid in any valid payment mode like net banking, digital channels, etc., except cash.

Frequently Asked Questions

1. Are there any exclusions under Section 80D?

Yes. There are three significant exclusions under section 80D

- If the individual is purchasing the health insurance policy of siblings, working children, or grandparents behalf, cannot avail of the tax benefits.

- If the policyholder is purchasing a health insurance policy through cash, he/she is not eligible for tax benefits.

- If the policyholder has a group health insurance premium provided by its employer, it won’t be eligible for tax benefits. However, if the policyholder purchases an extra cover or top-up health insurance plan, he/she can claim the tax benefits on the additional amount paid.

2. What is the difference between Section 80C and Section 80D of The Income Tax Act?

Income tax deduction under Section 80C eligible for payment made for life insurance premiums, investment in PPF, EPF, etc., equity-linked saving schemes, and payment made for the principal sum of SSY, SCSS, NCS, home loan, etc. In contrast, Income tax deduction under Section 80D eligible for payment made via debit or credit cards, cheque, draft, or online banking for health or medical

insurance premium for self and dependent family.

Final Thoughts

Health and medical insurance act as a financial backup at the time of a medical crisis, but one can benefit from investing in it under section 80D during the financial year. It encourages an individual to invest for the future.

*Standard T&C apply

Insurance is the subject matter of solicitation. For more details on benefits, exclusions, limitations, terms, and conditions, please read the sales brochure/policy wording carefully before concluding a sale.

Service Chat:

Service Chat:

Leave a Reply