Respect Senior Care Rider: 9152007550 (Missed call)

Sales: 1800-209-0144| Service: 1800-209-5858

Service Chat: +91 75072 45858

Service Chat: +91 75072 45858

Thank you for visiting our website.

For any assistance please call on 1800-209-0144

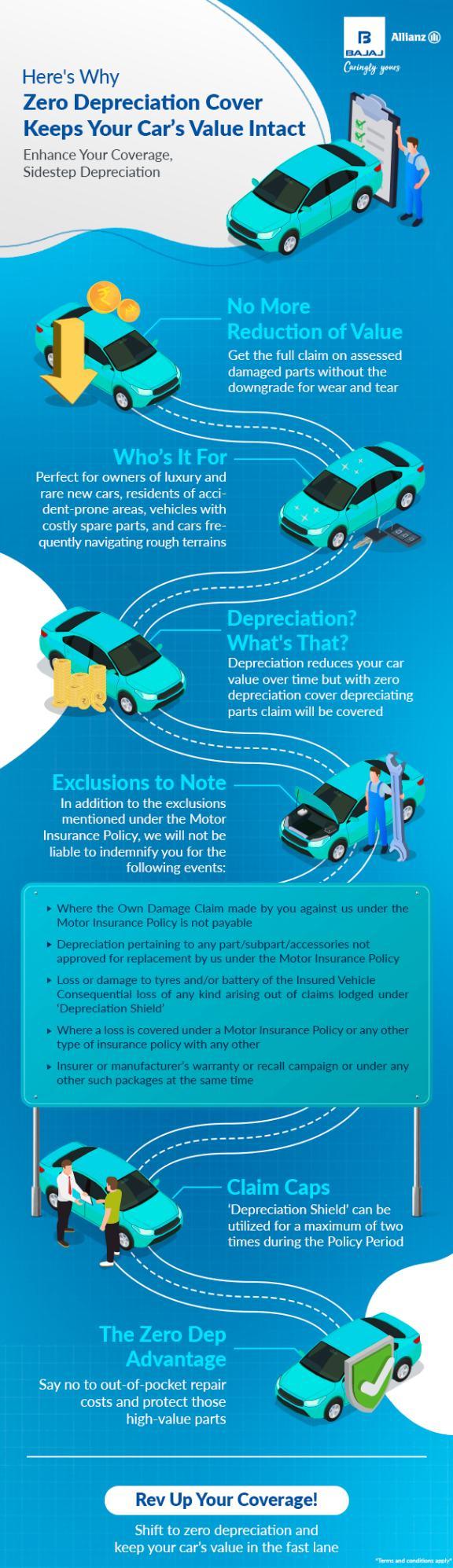

Depreciation refers to the gradual decline in value of an asset over time due to a combination of factors such as age, wear, tear and obsolescence. All vehicles are depreciating assets and at the time of insurance claim, every insurance company calculates and applies the depreciation rate to decide the total amount payable.

✓ Claim settlement ‐ Under this policy, depreciation does not affect the claim settlement and full compensation is provided to the insured.

✓ Only new cars are included ‐ Cars less than 3 years old are only included and only new car owners can purchase it.

✓ Has some notable exclusions ‐ A zero‐depreciation cover does not cover normal wear, tear and mechanical breakdowns. Every policyholder is bound to pay ay a mandatory policy excess.

✓ Claim limitation ‐ A zero‐depreciation add‐on cover has some claim limitations annually, though this might vary from one company to another.

✓ Repairing costs ‐ Any damage to fibre, glass, rubber and plastic parts are borne by the insurer.

✓ Higher premium ‐ Zero‐depreciation covers generally have higher premiums in comparison to a normal car insurance cover.

✓ Policyholders need not pay out‐of‐pocket expenses since the current cost is not taken into account.

✓ This type of insurance reduces worries a complete write‐off of a new car.

✓ Almost all the vital parts of the car are covered without taking into account the depreciation factor.

✓ People having luxury cars.

✓ People with new rare cars.

✓ People residing in accident‐prone zones.

✓ Cars having expensive spare parts.

✓ Roads filled with bumps and dents.

It is believed that this policy is appropriate for new or inexperienced drivers as they are likelier to get the car damaged. However, this cannot be regarded as always true, since in numerous cases, experienced drivers have also suffered accidents.

Explore more Car Insurance Features.

Written By : Bajaj Allianz - Updated : 25th April 2024

Share Your Details

Disclaimer

I hereby authorize Bajaj Allianz General Insurance Co. Ltd. to call me on the contact number made available by me on the website with a specific request to call back at a convenient time. I further declare that, irrespective of my contact number being registered on National Customer Preference Register (NCPR) under either Fully or Partially Blocked category, any call made or SMS sent in response to my request shall not be construed as an Unsolicited Commercial Communication even though the content of the call may be for the purposes of explaining various insurance products and services or solicitation and procurement of insurance business. Furthermore, I understand that these calls will be recorded & monitored for quality & training purposes, and may be made available to me if required.

Please enter valid quote reference ID